Understanding Health Insurance for Varicose Vein Treatments

Are you confused by your insurance plan? Hoping to avoid any surprises when it comes to your medical bill? This guide should help you understand the basics of your insurance policy!

Does Insurance Cover Varicose Vein Treatments?

Yes, but… Whether varicose vein treatments are covered by medical insurance depends on several factors, including the severity of the condition, the specific insurance plan, and the medical necessity of the treatment. Medicare does cover these treatments too! In many cases, if varicose veins are causing pain, discomfort, or complications, insurance may cover treatments that are considered medically necessary. These treatments might include procedures like radiofrequency ablation or sclerotherapy.

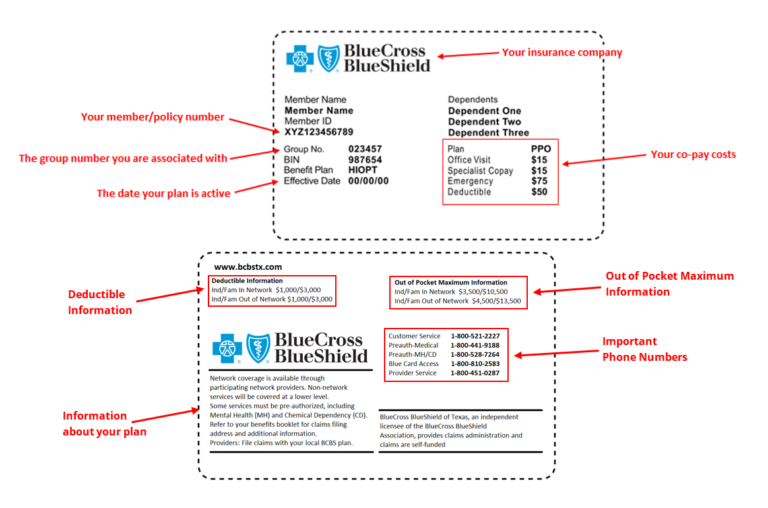

Understanding your Insurance Card:

Deductible vs Co-Payments vs Co-Insurance: What’s the Difference?

Deductibles: An insurance deductible is the initial amount of money that an individual needs to pay out of their own pocket before their insurance coverage kicks in to help cover the costs of medical services or other covered expenses. For instance, if you have a health insurance plan with a $1,000 deductible, you’re responsible for paying the first $1,000 of eligible medical expenses on your own. Once you’ve reached this deductible threshold, the insurance company will typically start sharing the cost of covered services with you through co-payments, coinsurance, or other arrangements, depending on your policy.

Co-Insurance: Medical insurance co-insurance is a percentage-based cost-sharing arrangement where the policyholder and the insurance company each pay a percentage of covered medical expenses after the deductible has been met. For instance, if you have a co-insurance rate of 20%, you would be responsible for paying 20% of the total cost of a covered medical service, while the insurance company would cover the remaining 80%. It’s important to note that co-insurance applies after the deductible is met and can continue until a certain out-of-pocket maximum is reached.

Co-Payments: A medical insurance co-payment, often referred to as a “co-pay,” is a fixed amount of money that an individual is required to pay for a specific medical service. Co-payments can vary depending on the type of service. For example, a health insurance plan might have a $45 co-payment for specialty care office visits, but $75 for a procedure. Co-payments provide predictability for patients in terms of their out-of-pocket costs and are separate from other cost-sharing methods like deductibles or co-insurance.

Conservative Measure Trial: What Is It? Why Is It Needed?

Many insurance payers often require documentation of conservative measures being attempted before approving coverage for certain varicose vein treatments.

Conservative measures generally refer to non-invasive or non-surgical approaches aimed at managing varicose veins before considering more invasive interventions. These measures might include wearing compression stockings, elevating the legs, exercising, and lifestyle modifications. Insurance companies may request evidence that these conservative measures have been tried and haven’t provided sufficient relief from symptoms or complications associated with varicose veins.

What’s The Difference Between HMO and PPO?

| Pros | Cons |

HMO | · | · · · |

PPO | · · · | · |

Check to see which plan your insurance policy follows so that there are no surprises at your next visit with your healthcare provider!

In-Network vs Out-of-Network Providers

Now that we have covered different plans, let’s talk about the difference between in-network and out-of-network providers.

In-network providers are healthcare professionals (doctors, specialists, etc.) and medical facilities (hospitals, clinics, etc.) that have a contractual agreement with your health insurance company. Because they have an agreement with your insurance company, they have agreed to provide services at negotiated rates, which are typically lower than their regular charges. When you visit an in-network provider, your insurance plan will generally cover a larger portion of the cost, and you’ll usually have lower out-of-pocket expenses (like co-payments or co-insurance).

Out-of-network providers are healthcare professionals and facilities that do not have a direct agreement with your health insurance company. Visiting out-of-network providers might result in higher costs for you, as these providers can charge their regular rates, which are not subject to the negotiated rates of in-network providers. Insurance plans usually provide less coverage for out-of-network services. You might have to pay a higher percentage of the total cost (co-insurance) or meet a higher deductible before the insurance starts covering costs. In some cases, insurance plans might not cover out-of-network services at all, and you might be responsible for the entire bill.

Spider Vein Treatments: Why Is It Not Covered?

Spider veins are typically smaller, dilated blood vessels that appear close to the surface of the skin. They are often considered a cosmetic concern rather than a medical necessity. Insurance companies generally prioritize coverage for medical conditions that have a significant impact on a person’s health and well-being.

It’s important to note that insurance policies and coverage criteria can change, and different insurance companies have different policies regarding coverage for cosmetic procedures. If you’re seeking treatment for spider veins, it’s a good idea to contact your insurance company and discuss your specific situation with them. Additionally, consulting with a medical professional can help determine whether the treatment is medically necessary and whether insurance coverage might be a possibility.

So, What Do We Do With All of This Information?

Now that we have covered all of the basics, it is important to understand how you are covered. To learn more about your coverage, give your insurance company a call!

Want to be treated by us but not sure if your insurance will cover it? Make an appointment with us! Before you arrive for your first visit, we verify and determine your benefits so that there are no surprises! In addition, we request and receive authorization prior to every procedure and run cost estimates based on your insurance’s fee schedule.

Key Takeaways

- Insurance does cover treatments for varicose veins! If you are having symptoms, often times insurance will deem the treatments medically necessary.

- Medicare does cover treatment for varicose veins!

- Your insurance card is full of helpful information regarding your plan!

- Deductibles, co-insurances, and co-payments are different and understanding the differences can help prevent confusion.

- Often times insurance requires a period of conservative trials to be met before they will authorize the treatment of varicose veins.

- Spider vein treatments are often deemed medically unnecessary and therefor not covered by insurance.

- Understanding your insurance policy will make your visit with a provider much smoother and will prevent any surprise medical bills!

Worried About Your Veins?

Click here to Make an appointment to see Dr. Husein Poonawala at our vein clinic in Flower Mound, Texas to have your veins assessed and treated today!

Our quick and easy, walk-in walk-out appointments and treatments can get your veins optimized.

Dr. Husein Poonawala is the driving force behind The Vein Clinic of Dallas. He is a dual board-certified Harvard trained Vascular and Interventional Radiologist with a passion for treating vein disorders. He is an expert in minimally invasive endovascular surgery with over a decade of experience in his field. He now focuses solely on venous insufficiency utilizing state-of-the-art vein treatments.

The content provided in this article is provided for information and educational purposes only and is not a substitute for professional medical advice and consultation.